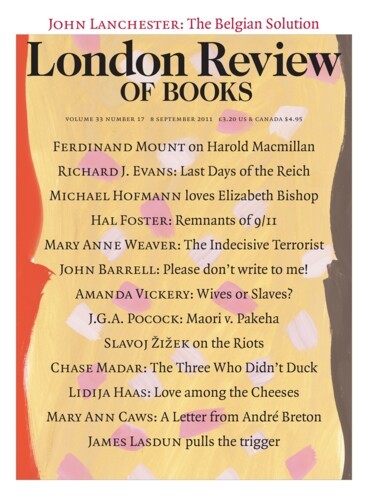

Quarterly GDP data don’t, on the whole, tend to make the person studying them laugh out loud. The most recent set, however, are an exception, despite the fact that the general picture is of unrelieved and spreading economic gloom. Instead of the surge of rebounding growth which historically accompanies successful exit from a recession, we have the UK’s disappointing 0.2 per cent growth, the US’s anaemic 0.3 per cent and the glum eurozone average figure of 0.2 per cent. That number includes the surprising and alarming German 0.1 per cent, the desperately poor French 0 per cent and then, wait for it, the agreeably frisky Belgian 0.7 per cent. Why is that, if you’ve been following the story, laugh-aloud funny? Because Belgium doesn’t have a government. Thanks to political stalemate in Brussels, it hasn’t had one for 15 months. No government means none of the stuff all the other governments are doing: no cuts and no ‘austerity’ packages. In the absence of anyone with a mandate to slash and burn, Belgian public sector spending is puttering along much as it always was; hence the continuing growth of their economy. It turns out that from the economic point of view, in the current crisis, no government is better than any government – any existing government.

I’m told that the cliché du jour in financial markets involves reference to ‘uncharted territory’. It’s things like the GDP figures which are responsible for that. We’re deep in the land of Rumsfeld’s unknown unknowns. (Why, incidentally, was he so widely mocked for talking about the difference between known and unknown unknowns? It seems to me an immensely useful distinction, not least as a way of describing the difference between what economists call risk, which markets can measure and therefore like, and uncertainty, which they can’t and therefore hate.) A major contributor to this sense of unchartedness was the decision by the ratings agency Standard and Poor’s to downgrade US government debt from AAA to AA+ status. This might seem like a small technical point, and it’s worth noting that the downgrade had no effect on the price of the debt, meaning that the markets felt it had no practical consequences – but that’s not the issue. The dollar is the de facto global ‘reserve currency’, meaning that it is held in significant quantities by countries and institutions all round the world, and that it is the currency used to price the huge global markets in commodities. In effect, the dollar is the currency we earthlings prefer to use. The fact that the US can print as much of this global reserve currency as it likes is an inestimable economic advantage and gives it more or less unlimited power to borrow money in times of trouble, since it can issue IOUs with one hand and print the currency to pay them off with the other. This is an easy – a very easy – power to abuse by accumulating huge debts, but what caused the downgrade wasn’t America’s debts per se. Instead, it was the Congressional Republicans’ brinkmanship over what should have been the routine raising of the ceiling on the total amount of US debt. The deal on offer to the Republicans was described by the conservative commentator David Brooks as ‘the deal of the century’, offering ‘trillions of dollars in spending cuts in exchange for a few hundred billion dollars of revenue increases’:

A normal Republican Party would seize the opportunity to put a long-term limit on the growth of government. It would seize the opportunity to put the country on a sound fiscal footing. It would seize the opportunity to do these things without putting any real crimp in economic growth.

The party is not being asked to raise marginal tax rates in a way that might pervert incentives. On the contrary, Republicans are merely being asked to close loopholes and eliminate tax expenditures that are themselves distortionary.

This, as I say, is the mother of all no-brainers.

But we can have no confidence that the Republicans will seize this opportunity. That’s because the Republican Party may no longer be a normal party. Over the past few years, it has been infected by a faction that is more of a psychological protest than a practical, governing alternative.

Brooks called it correctly: the Republicans, egged on by their newly empowered Tea Party wing, didn’t take the deal, and forced the debate on raising the debt ceiling right to the edge of an unprecedented and globally catastrophic US default. The process ended with surrender on the part of President Obama and the Democrats. There is near unanimity among economists that the proposals in the agreed package will at best make recovery from the recession more difficult, and at worst may trigger a second, even more severe downturn. The disturbing thing about the whole process wasn’t so much that the Tea Partiers were irrational as that they were irrationalist: they were consciously pursuing a course of action which made no economic sense, as part of a worldview which is essentially theological. They know that everyone else knows that they truly don’t care about the consequences of their actions, and the prospect of the Tea Party wing being in government is truly frightening. ‘Sane Republican’ is not an oxymoron, not yet – but we’re heading that way.

In other respects, though, the idea that the current crisis represents a new development is mistaken. In most respects the state we’re in is all too thoroughly charted. Its three salient features are the same ones we’ve been living with since autumn 2008. That’s because they are in essence the same crisis. The outstanding features of this crisis are debt, political failure, and the structural brokenness of the global banking system. All three are linked; in a sense, all three are the same phenomenon. The collapse in stock-market prices which has been causing headlines all summer is based on the weak economic data coming out of the developed economies, which in turn are causing people to think that the world isn’t going to manage to grow its way out of the debt crisis caused by the 2008 crash.

If economies aren’t growing, they’re going to have trouble repaying their debts – debts which, to a large extent, they took over from the global banking system, to keep it solvent. As I argued when writing about the Greek crisis (LRB, 14 July), this is a huge problem for the eurozone in particular. The euro story has continued to evolve in the direction it was always likely to take, with the ‘contagion’ of uncertainty spreading. At the moment, the downward charge of market indexes is being propelled by a conviction that Europe’s banks are in much more trouble than anyone wants to admit. This is something which has been widely asserted in the ‘Anglo-Saxon’ world for some time. It’s lucky I’m not a trader actively involved in the financial markets, because if I were, I would have permanently lost my shirt – I would have ‘blown up’, as traders call it – in 2009, betting everything I own against the euro, on the basis that its banks were just as broke as the ‘Anglo-Saxon’ ones, with the only difference being that they hadn’t admitted it yet. They still haven’t admitted it. A piece by Gordon Brown, in the always anti-European Herald Tribune, had a real edge of anger on this point. ‘I was present at the first meeting ever held of the eurozone heads of government in October 2008, in the immediate wake of the Lehman Brothers crash,’ Brown said.

I explained that Europe’s banks were under-capitalised by billions and that the prospect of them collapsing jeopardised the safety of the entire European economy – we could not run capitalism without capital.

I remember the sceptical looks when I explained that European banks were in fact more vulnerable than American banks, that they were far more highly leveraged and far more dependent on short-term wholesale funding. In fact, half of America’s toxic sub-prime assets had been bought by reckless institutions in Europe. Worse still – as we have subsequently discovered – the greater the European banks’ problems, the poorer their insurance coverage, the worse their leverage and thus the more dangerous the risk to us all.

Yet even as the crisis grew, it was difficult to get Europe’s leaders to accept that it was anything other than an Anglo-Saxon one. By convincing themselves that the problem was simply fiscal, they have drawn back from taking proper action.

Brown is right; just how right became clear later on 16 August, the same day his piece was published. Sceptics in bank shares had been ‘short-selling’ them. Short-selling is on the decent-sized list of practices which seem bizarre to civilians but to insiders are a routine feature of how modern markets work. A short-seller borrows shares in a company, and then sells them, with the intention of buying them back at a cheaper price, returning them to the lender, and trousering the profit. Say you decide that, to take one purely hypothetical example, News Corp is overvalued because – oh, I don’t know, just to make something up – because all its senior management are going to go to jail. The current price is $15.80 and you reckon it’s heading for ten bucks. So you find a willing lender, borrow one million shares with an agreement to return them on a specific date, and then you sell them. Notice that this selling is not a neutral event: by dumping $15.8 million of News Corp stock you actively help to drive prices down. Critics of short-selling point out that this shades into a form of market manipulation, which is illegal. A short-seller isn’t just betting on an outcome, he (it’s usually a he) is trying to bring it about. Anyway, some months pass, the News Corp execs are charged with multiple malfeasances, the stock tanks to $10, you buy back the million shares – this is called ‘covering the short’ – and give them back to the lender.* You have benefited by the difference between $15.8 million, which is the amount which you banked when you sold the shares, and $10 million, which is what it cost you to buy them back: $5.8 million. Nice ‘work’ if you can get it.

A lot of short-selling is done by hedge funds. In the case of the current euro crisis, hedge funds are shorting specific banks, principally European ones, which they believe to be undercapitalised, as per Gordon Brown above. (Just because they’re evil doesn’t mean they’re wrong on the substantive point.) The European governments reacted in the way they tend to do, by issuing a temporary ban on short-selling in France, Belgium, Italy and Spain – a not so subtle clue as to the location of the targeted banks. Crying ‘foul’ in this manner doesn’t impress the markets much, and the banks’ predicament worsened. The European Central Bank figures tell the story: in a single week, they provided €22 billion in emergency funding. The total amount of support to one (unnamed) bank amounted to $500 million. ECB lending on that scale can’t be kept up, but numbers that big are necessary because other banks had stopped lending to the endangered banks – and banks being scared to lend to other banks is the exact formula which didn’t just cause the credit crunch, it was the credit crunch.

On 16 August, Nicolas Sarkozy and Angela Merkel had an emergency meeting to decide what to do about the Eurozone crisis. After it, they gave a press conference at which they spoke in platitudes about the need for Europe to improve its ‘economic governance’, avoiding all specifics. They precisely and explicitly ruled out the only two things which would have helped: the creation of ‘eurobonds’, i.e. debts backed by the full economic weight of all the countries inside the eurozone; and the extension of the €440 billion European Financial Stability Facility. It’s easy to see why they did this, and their reasons are entirely to do with the domestic unpopularity of giving more aid to the indebted and severely struggling ‘Club Med’ countries of Southern Europe. Unfortunately, Merkel and Sarkozy’s inaction is a recipe for certain disaster. Everybody and his cat knows that the eurobond is the only way out of the crisis for the eurozone in the medium term; as for the necessary size of the short-term bailout facility, Gordon Brown’s guesstimate was €2 trillion. That ‘could have convinced the markets that Europe meant business’. Huge, sustained and manifestly undeflectable government intervention on that scale is the only thing which will cause the speculators and hedge-funders and ‘hot money’ types to back off. Instead, nothing. The markets expressed their opinion the only way they know, and on 17 August, the ECB had to lend another €9-10 billion to the endangered banks.

It is this failure of political will both in the EU and US which is starting to make the contemporary economic scene resemble that of the 1930s. The discipline of macro-economics was born out of the study of the Great Depression, in an attempt to understand what had happened and avoid a repetition. That’s why it’s so depressing to see the developed world not just sleepwalking towards another recession, but actively embracing policies which make it more likely. Governments can’t all simultaneously cut spending while also continuing to grow their economies: it just defies common sense to think they can. The problem is in large part to do with the application of an incorrect metaphor, the easy-to-understand idea that a household has to live within its income. But governments are not households, and the idea of cutting your way to prosperity cannot be read across from an individual’s finances to those of the state. It’s a manifest fact that these policies, and the refusal to embrace stimulus spending, are causing economic slowdowns all over the world that are triggering the current anxiety in the markets, which is in turn causing the predicament of governments to intensify, as confidence sinks and the self-fulfilling expectations of a second downturn take hold. This in turn puts pressure on expectations about governments’ abilities to repay their debts, which further lowers confidence, and so on.

It’s starting to look as if the best-case scenario for the aftermath of the crash is already dead. In that version, governments muddled through to economic growth, cutting public spending in the process, enjoying the already mentioned rebound which tends to follow recessions, and the developed world went back to partying like it was 2006. This prospective version of events had a big hole at the centre, about the way the financial sector should be reformed; in any case, it now looks very unlikely to happen. The next scenario – the one we are on course for at the moment – is not so much the next-best as the next-least-worst. It is modelled on what happened to other parts of the world over recent decades, from Latin America to Russia to South-East Asia, as they underwent debt crises and consequent economic collapse. In all cases, the relevant economies recovered, after about a decade of hard times and widely shared economic pain. In this model, the debts are gradually paid down, the economy is slowly and miserably rebalanced, and eventually things grow back to where they were when the bubble burst. There is a general sense of baffled incomprehension in the West at the idea that this should be happening to Us, instead of to Them; it turns out that this trajectory of crisis and slow recovery is a lot more bearable when it happens to other people, ideally in far-away countries of which we know little. But that is what we look to be on course for at the moment.

Would that matter? It would be a fairly important chapter in the Decline of the West, to be sure; it would matter to those of us who live here; but in the very broadest economic and historical perspective, it might only be an acceleration of trends which are already in place. We are on course for relative decline, compared to China and India and the developing world; indeed, we are already living through it, with China now the world’s second biggest economy. A decade-long slowdown would accelerate this shift in global wealth and power and would be a grim thing to live through, but from a world-historical perspective it might not be a game-changer: it might just be the non-scenic route to the place we’re going anyway.

What makes the process so frustrating is that the measures which might be taken to avoid the years of stagnation seem fairly obvious. The first of them is to embark on a medium-term plan of stimulus and spending to help growth; to postpone the cuts and austerity and rebalancing of spending until that growth is established; and to embark on a global plan to reform the financial system. This plan would have to be co-ordinated and international, and it might well involve a shift towards what is being called the ‘utility model’ of banking. In this, the banking industry is re-regulated along the lines of a public utility such as water or electricity, businesses whose public importance and function is obvious, and ones in which heavy levels of regulation play an important role in protecting the public interest. The profit motive for investors plays an acknowledged role too, but the profits are in effect determined by government: the rules are set up to make clear how the businesses will be run, what they can and can’t do, including, roughly, how much money they are allowed to make. Many of the casino-like activities in which banks currently engage – most of which are zero-sum practices of no social utility in which one side bets against another and one wins, one loses – will be banned. Or, as the Cambridge economist Ha-Joon Chang has suggested, they might be subjected to the same regulatory regime as drugs, in which new products are banned unless and until they can be proved to be safe.

There is, just, time for this change of course to happen, before it’s all too late. But I fear that the grip of anti-spending ideology is so strong throughout the West, and the politicians’ fear of the banks is so entrenched, that the ten-year slog looks more likely. Oh strangest of all strangenesses, the deep longing for the whole world to be more like Belgium.

Send Letters To:

The Editor

London Review of Books,

28 Little Russell Street

London, WC1A 2HN

letters@lrb.co.uk

Please include name, address, and a telephone number.