The Institute of Economic Affairs is approaching its 50th birthday, and has much to celebrate. It was founded in the heyday of the so-called Keynesian consensus that dominated British political economy for about thirty years after World War Two. The mission of the IEA was to challenge that consensus through an intellectual assault on its foundations and to proselytise instead for free-market remedies. This looked like an uphill struggle at the time. Keynesian economics seemed to have carried the day not only in the universities but in Whitehall, whichever party was in power. Harold Macmillan was on the verge of a long premiership, during which he often reaffirmed his fealty not only as Keynes’s publisher but as his disciple.

Within a generation the IEA not only saw the climate change but could claim that it had helped to make the weather. It became the prime source of new ideas – well, old ideas for the most part, but nicely freshened up – which pervasively made their way from its published tracts into wider economic debate and from there into politics, eventually becoming known as Thatcherism. Never has a think-tank nurtured a bigger fish. Not that the IEA departed from its initial decision to abjure any overt political affiliation; its method was different. ‘The IEA would be the artillery firing the shells (ideas),’ was how its first editorial director put it. ‘Some would land on target (the intellectuals), while others might miss. But the Institute would never be the infantry engaged in short-term, face-to-face grappling with the enemy.’ Whatever induced these otherwise hard-nosed people to believe that such a strategy might work?

The answer was proudly displayed in a framed text that hung on the wall of their front office. I have never made the pilgrimage to see it and remain content to imagine it as reverently executed in poker-work, like an old-fashioned scriptural motto. Certainly it provided the inspiration for the efforts of all the artillery officers, from General Hayek, in his Swiss château, to Colonel Friedman, on secondment from the US artillery, to recruits like Major Walters, not yet a staff officer treading the backstairs of 10 Downing Street, as well as a phalanx of fresh-faced subalterns, all set on loading the shells into the breech to fire off in the next IEA bombardment. Their order of the day is worth quoting at its original length:

The ideas of economists and political philosophers, both when they are right and when they are wrong, are more powerful than is commonly understood. Indeed, the world is ruled by little else. Practical men, who believe themselves to be quite exempt from any intellectual influences, are usually the slaves of some defunct economist. Madmen in authority, who hear voices in the air, are distilling their frenzy from some academic scribbler of a few years back. I am sure that the power of vested interests is vastly exaggerated compared with the gradual encroachment of ideas. Not, indeed, immediately, but after a certain interval; for in the field of economic and political philosophy there are not many who are influenced by new theories after they are 25 or 30 years of age, so that the ideas which civil servants and politicians and even agitators apply to current events are not likely to be the newest. But, soon or late, it is ideas, not vested interests, which are dangerous for good and evil.

The author of this passage was John Maynard Keynes. His words were not carelessly uttered but form the pregnant last paragraph of his magnum opus, The General Theory, published in 1936. This obviously expressed his hope that his own ideas would be disseminated through such a process and in this sort of trajectory. Quoting the passage in 1947, a year after his great rival’s death (though oddly, still employing the present tense), Hayek said that Keynes ‘has never said a truer thing’, moreover ‘on a subject on which his own experience has singularly qualified him to speak’. Hayek clearly meant that the reception of Keynes’s ideas, in conquering initial scepticism, had validated his hope and claim about the power of economic ideas (just as the claim itself might in turn come to validate the hope of achieving a counter-coup). In either case, though the substantive effect might be different, the process was assumed to be the same.

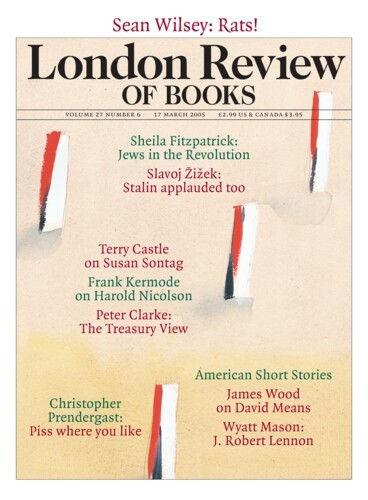

It is this general assumption about the influence of theoretical ideas on public policy that has underpinned much of the vast literature about the Keynesian revolution. For what distinguishes Keynes is that he remains a commanding figure both in the history of economic theory and in the history of economic policy, especially that pursued by the British Treasury. It still makes sense to ask how far Treasury policy – even today – can be analysed in Keynesian terms. But such questions need to be properly framed (like the IEA’s text). It is no longer enough to invoke a simple paradigm of influence, based on an implicit intellectual hierarchy: a model in which ideas have an immaculate conception in a purely abstract form in the minds of great thinkers, whose theories are then disseminated, albeit with a natural pedagogic time-lag, to the rising generation who knowingly or unknowingly implement them.

These days historians are conscious that if we are concerned with the influence of economic ideas, we need to concentrate on their reception as much as their genesis. Once the artillery has performed its ballistic feats, somebody has to take and hold the ground, wading through the mud of the shell-holes to clear up the mess, and all the while taking the decisions that are immediately necessary. The poor bloody infantry also deserves recognition and historical commemoration.

This may seem a back-handed way of paying tribute to the work of George Peden, whose iron-clad research in the public records has established him as the leading authority on the 20th-century Treasury, which long served as the butt of much of Keynes’s criticism of British economic policy. Nobody has documented its activities more authoritatively than Peden or more convincingly entered into the mentality of the Treasury knights, whose arguments for resisting Keynes used to be caricatured by second-generation Keynesians as simply laughable. Keynes and His Critics, by printing their internal memoranda and minutes, allows them to speak for themselves. Here is the other side of the story, from the point of view of the unsung, long-suffering, largely anonymous, patiently serviceable infantry.

Some of the leading characters, admittedly, were infantry officers of some eminence. In the page of mug-shots at the end of this book, Sir Warren Fisher, head of the Civil Service and nominally of the Treasury, too, for virtually the whole interwar period, looks wonderfully haughty and disdainful in his black topper. Sir Richard Hopkins, who headed the Treasury team for most practical purposes in the 1930s before belatedly becoming permanent secretary himself, is caught looking obliquely, intently, thoughtfully – not a man to be underestimated – while his close colleague Sir Frederick Phillips looks as though he has been propped up against a wall by a Keynesian commando as one of the usual suspects but carries a despondent air of being wrongly accused.

Much more satisfactorily typecast as one of the guilty men is Sir Otto Niemeyer. He switched in 1927 from the Treasury to the Bank of England, where he stayed for a quarter of a century, and faces us down in this photograph with his basilisk stare: the Balliol man who had come top of the Civil Service exams in 1906, with J.M. Keynes of King’s College, Cambridge, in second place – never to be forgotten. Sir Ralph Hawtrey, by contrast, the Treasury’s house economist, had been 19th wrangler in the mathematics tripos at Cambridge in 1901 (his friend Keynes 12th wrangler in 1905), and gazes out, donnish and myopic, through horn-rims. More truculent and quizzical, Sir Wilfrid Eady, Hopkins’s deputy from 1942, squints through his penny-round spectacles, as though still uneasy over the economic gaps in his education as a classicist at Jesus College, Cambridge, or still smarting from Keynes’s last gibe at him. (‘If I had taken you very young and had limitless patience, I might have taught you the elements of economics. As it is, I must assume that you understand your own art of administration.’) A fairly tight-knit group, then, schooled at a small number of Oxbridge colleges, and with involuted experiences and rivalries that went back a long way.

The photograph of Sir Frederick Leith-Ross stands out as much the best. It is a shot of him in a stylish soft hat at a train window, relaxed and confident, taking his pipe out of his mouth, as though to exchange some genially barbed repartee. A Balliol man, like Niemeyer, whose loyal deputy he had been, ‘Leithers’ found his career somewhat eclipsed by the rise of Hopkins at the Treasury before himself being promoted to the new post of chief economic adviser in 1932. The faintly weary, slightly testy tone Leith-Ross adopts in 1930, faced with Keynes’s critique of Treasury policy before the Macmillan Committee on Finance and Industry, is surely that of the battle-hardened infantry officer, impatient at the pretensions of the artillery.

‘The fact is that Keynes, like other economists, lives in a world of abstractions,’ Leithers tells his colleagues. ‘He speaks of “Industry”, “Profits”, “Losses”, “Price level” as if they were realities. In fact, we have no such thing as “Industry”. What we have is a series of different industries – some prosperous, some depressed and a number carrying on normally.’ There is a fundamental issue at stake here: how far any propositions in economic theory can be applied to the intractable difficulties of a world where everything turns out to be much more complex and muddled than under the conditions airily specified, for the sake of simplicity, in the theory. When Keynes asked why an impoverished country could not solve its problems by simultaneously mobilising unused savings and unemployed workers, the rhetorical appeal was beguiling. Yet the Treasury surely had a point in advising that these eloquently publicised pleas should be tempered with some necessary caution; that they should be subjected to searching appraisal; that they should be investigated for administrative feasibility before being implemented; and that hopes of easy success should take into account the Treasury’s own hard-won experience (which ministers should be aware was frankly rather disappointing).

But this, too, is a kind of rhetoric, and need not be taken at face value. Back in 1925, when the argument had been over Britain’s return to the Gold Standard, Niemeyer had not been afraid to take a hard line that was ‘necessarily put in a doctrinaire way’. The return to gold might face British industry with temporary difficulties, now that exports were uncompetitive at the new exchange rate; but prices were surely flexible, were they not? Niemeyer had dismissed Keynes’s counter-arguments in forthright terms – ‘To me they seem sheer lunacy’ – and had done so in the confidence that economic trends were on his side. He predicted that prices, and hence unemployment, would duly fall as the orthodox theories prescribed, in which case ‘a good deal of Mr Keynes’s argument will fade away.’

But fade it did not. ‘Keynes says that, despite the general reduction of price levels since 1925, there has been no appreciable reduction during the same period in the rates of wages paid to labour in the United Kingdom,’ Leith-Ross subsequently noted, with evident puzzlement. He expostulated to Hawtrey, who was paid to know things like this, that ‘it appears to be so surprising that I should be glad if you would go into it.’ Hawtrey duly checked the figures: alas, it was so, and Keynes was right. Previous historians who have worked on these Treasury files have been in error (and I readily admit to it myself) in thinking that it took the Treasury four years to wake up to the fact that British prices and wages were disobeying the laws of economics, which insisted on their axiomatic flexibility. Peden shows that in fact it took the Treasury even longer to make this unwelcome discovery.

By 1930, then, the brute facts seemed to vindicate Keynes rather than the Treasury, still less the Bank of England, in the argument about prices, wages and unemployment. This being so, it was clearly politic to adopt a less trenchant tone, especially since the government’s nominees on the Macmillan Committee included Keynes himself. Luckily, the post of controller of finance and supply services at the Treasury was no longer occupied by the abrasive Niemeyer but by the emollient Hopkins. When the Treasury evidence had to be given to the members of the committee, over whom Keynes, with his big ideas for radical action, had established an alarming intellectual ascendancy, it was Hopkins’s moment.

The ‘Treasury view’ had already become a term of art for its contention that any increase in government spending on public works would crowd out an equivalent amount of private investment, and thus fail to reduce unemployment. Well prepared himself, and well briefed by Leithers, Hoppy executed an adroit tactical retreat, leaving the Treasury free to fight on its own chosen ground of administrative feasibility. Was there a Treasury dogma which ruled out public works schemes? No, no, as the chairman could now see: it had been ‘a little misunderstood’. Indeed, the Treasury view, as a baffled Keynes had to acknowledge, ‘bends so much that I have difficulty in getting hold of it’.

It is nonetheless pretty obvious that many in the Treasury were happy to find arguments for resisting schemes for which they could summon neither ideological enthusiasm nor theoretical approval. Keynes’s response was on two levels. When it came to practical policy proposals, he argued with the Treasury on its own terms and sought allies in whatever quarter seemed promising. But he was also engaged in a rethinking of the economic theories on which he had been brought up; and in this quest the dogmatic formulation of the Treasury view provided him with an intellectual stimulus. Its contention that extra investment (by government) would simply displace other activity surely rested on an unargued assumption that all factors of production were already employed. Suppose, however, that aggregate investment were increased in a situation of chronic unemployment – would not aggregate incomes rise all round? And the effects multiply? Such questions were prompted in Keynes’s mind not only by the abstract speculations of his clever young Cambridge friends but by immediate policy arguments with the Treasury knights.

Legitimate differences were often a matter of temperament rather than theory. Phillips, who emerges as more open to persuasion than his colleagues, came to take the view, as the 1930s unfolded, that Keynes was his own worst enemy (though maybe not while Niemeyer was around). Thus Phillips did not see how it could be denied that the rearmament programme undertaken by the Chamberlain government in 1939 would have the effect of reducing unemployment. The fact that Keynes said so did not make it untrue. It was the polemical nature of his advocacy – ‘marked by Mr Keynes’s customary optimism, over-emphasis and neglect of ulterior consequences’ – that seemed to Phillips to weaken the force of Keynes’s analysis: ‘It is almost as though he sets himself out to instil distrust in his readers.’

What, then, was the argument really about? In the triumphalist Keynesian literature it was all about the forces of light overcoming the forces of darkness. Thus it was intellectual enlightenment that ultimately caused the practical capitulation of the Treasury to policies that they had hitherto resisted, once the obscurantist theories on which they had relied had become discredited. The story that Peden documents is at once somewhat duller and much more interesting. Duller only in the sense that the black and white clashes of the heroic version cannot survive the exhumation of successive careful Treasury drafts in which the various shades of grey are fastidiously discriminated. More interesting, though, once we can follow the subtlety of a sophisticated argument which was conducted on a number of levels.

It ought to come as no surprise that busy Treasury officials did not sit around debating what they had learned in their bedtime reading of the General Theory. It was a work, as Keynes said in the preface, ‘chiefly addressed to my fellow economists’. That certainly included Hawtrey, the only professional economist in the Treasury, though correspondingly removed from the hurly-burly of decision-making on policy issues. Many of the extensive memoranda on theoretical economic issues that Hawtrey had time to compose are usefully reprinted. They show his own close engagement with the development of Keynes’s thinking and his contributions to the making of the General Theory. But Hawtrey remained, in every sense, his own man. He had his own vision as an economist and when Keynes’s ideas were conveyed to his colleagues, it was inevitably a view of Keynes through Hawtrey’s own thick spectacles. All told, this means not only that Hawtrey had more effect on Treasury policy than has often been acknowledged but also that he gave his own twist to what the Treasury came to understand as the Keynesian revolution.

The essence of the revolution was surely the introduction of an agenda we would immediately identify as macro-economic. It is not a term that Keynes ever used himself but the point is sufficiently made by his own emphasis on the importance of understanding how the economy works as a whole. Hence his concern with analysing aggregates – income, investment, saving – in a way that has clear implications for public policy. Thus a theoretical distinction between micro and macro-economic issues, which lies at the heart of the General Theory, can be put to work in justifying policy measures for managing and regulating the performance of the economy.

There is fascinating evidence in this book showing how the Treasury came to appreciate the significance of this central insight and suggesting how it could be made operational. Just before the outbreak of World War Two, Phillips chaired a Treasury committee charged with reconciling the increased government spending that would be necessary in wartime with the avoidance of inflation. The answer, it became clear, lay in understanding the aggregate dimension – because savings were produced out of the increased income (and employment) generated by an initial investment financed by borrowing. Hence the bland statement that ‘the very expenditure of money by government on loan account is all the time, as the fall of the unemployment figures bears witness, creating additional income.’ The multiplier was the essential mechanism here, showing how aggregate savings equalled investment through an expansion of aggregate income.

So far, so Keynesian. Keynes had been using such arguments for years to justify loan-financed public works as a remedy for unemployment. In doing so he was adumbrating a macro-economic regulation of the economy via changes in investment, prompted by government if private enterprise failed. It was a fiscal approach, relying essentially on government’s responsibility for taxing and spending and borrowing. This line of thinking was soon to take more explicit shape, under war conditions, in the formulation of the 1941 budget. Keynes was himself inside the Treasury by that point, as a special adviser to the chancellor, and had actively encouraged the use of national income accounting as the way of making what we would now call the budget judgment. Thus the budget was not just devoted to raising government revenue but to regulating the economy as a whole – sufficient reason for Keynes to call it ‘a revolution in public finance’.

He was to use very similar language in 1944 about the coalition government’s commitment to maintaining a high and stable level of employment after the war – it was ‘an outstanding state paper which, if one casts one’s mind back ten years or so, represents a revolution in official opinion’. And so it did. Sir Wilfrid Eady, who had chaired the steering committee charged with drafting the white paper, may have been an obstinately slow learner and an unlettered Keynesian but he knew well enough that times had changed. Stung by Keynes’s criticism that the concept of the multiplier had been given insufficient recognition, Eady asked plaintively: ‘Does not Lord Keynes feel that in paragraph 137 the committee have sufficiently acknowledged the doctrines which he has been trying to make the public service understand over the last 15 years?’

A Damascene scenario after all? Up to a point. Let us go back to what Phillips, apparently Keynes’s earliest and readiest Treasury pupil, was actually saying in 1939. Yes, he stuck up for Keynes, even against Hawtrey, on the beneficial effect of government spending on employment. There is no doubt that Phillips readily accepted a macro-economic analysis. But so did Hawtrey. The Treasury’s tame economist had spilt as much ink agreeing with Keynes about the importance of treating income and investment and saving in aggregate terms as he had in disagreeing with his old friend about the desirability of public works. Whereas Keynes maintained that investment was the key to recovery, Hawtrey persisted in regarding this as a mere side effect, masking the fact that the real agent of expansion was the inflationary effect.

Inflation, for Hawtrey, was not to be judged as good or bad in itself. It all depended on whether the economy was currently in need of deflationary or inflationary treatment. His readiness to pioneer the term ‘reflation’ indicates the possible beneficial role assigned to it in balancing the economy as a whole. Little wonder, then, that whenever Hawtrey was asked to comment on Keynes’s analysis he tended to use it as an opportunity to reiterate his own long-established views. And not without cumulative impact on his colleagues. ‘I agree with Mr Hawtrey that the real stimulus comes from reflationary finance,’ Phillips wrote in April 1939. ‘If there were no reflationary finance, the government works would tend merely to replace private works without much effect on employment. But this is the famous or infamous “Treasury view”, still a most bitter subject of controversy which it would be a great mistake to raise.’

This is all very well in its remote scholarly way, one may think, at least for those who like to follow the fine points of arguments that are now over and done with. After all, did Keynes not win in the end, and is Hawtrey not long forgotten, along with the other Treasury knights of that era? The implications in the long run, however, may be worth considering. Given that virtually everyone eventually saw the point of thinking in macro-economic terms, what Keynes suggested the Treasury should do was to regulate the economy through fiscal means: to some extent by changing tax rates, but more important by regulating public investment. And interest rates could thus remain permanently low. Nonsense, Hawtrey said, believing that macro-economic regulation, though necessary and desirable, had to take another form altogether. ‘The fact is that “cheap money” is not possible as a permanent policy,’ he advised the Treasury in 1939. He offered an alternative macro-economic strategy based on stabilising prices through regulating consumer demand. So a flexible monetary policy, applying deflationary or reflationary pressure as required, was what the Treasury needed. Or rather, it could administer such a policy at arm’s length, which he liked to call the art of central banking.

It would be absurd to unmask Hawtrey as the defunct economist of whom the Treasury are even now slaves. Nonetheless, a role for interest rates in regulating the economy – notably through a credit squeeze to jam on the brakes – has been accepted by every chancellor since Butler succeeded Gaitskell in 1951. And when Brown succeeded Clarke in 1997, the point was even more decisively entrenched. Responsibility for setting the base rate became the task of an independent Monetary Policy Committee, charged with keeping inflation within a specified range, through symmetrical adjustments, up or down. It is this strategy, rather than any attempt at fiscal fine-tuning, that underpins Brown’s policy on inflation. Where he is much more faithfully Keynesian is in his fiscal policy, proclaiming borrowing for public investment as a virtue so long as the ordinary budget is brought into balance over the economic cycle. In the long run, as Keynes once said, we are all dead; but not all these arguments are moribund.

Send Letters To:

The Editor

London Review of Books,

28 Little Russell Street

London, WC1A 2HN

letters@lrb.co.uk

Please include name, address, and a telephone number.