It's alive!

Thomas Jones · Robert Harris

Apocalypses aren't what they used to be. Thirty years ago, science fiction stories about sentient computers taking over the world tended to imagine them trying to wipe us all out using nuclear bombs (The Terminator, War Games). These days, if Robert Harris's new novel, The Fear Index, is anything to go by, the rogue AI's weapon of choice is the financial markets. 'Tales of computers out of control are a well-worn fictional theme,' Donald MacKenzie wrote in the LRB earlier this year,

so it’s important to emphasise that it is not at all clear that automated trading is any more dangerous than the human trading it is replacing... What needs weighing against this, however, are the implications of one strange and disturbing episode that lasted a mere 20 minutes on the afternoon of 6 May 2010. The overall prices of US shares, and of the index futures contracts that are bets on those prices, fell by about 6 per cent in around five minutes, a fall of almost unprecedented rapidity (it’s typical for broad market indices to change by a maximum of between 1 and 2 per cent in an entire day). Overall prices then recovered almost as quickly, but gigantic price fluctuations took place in some individual shares.

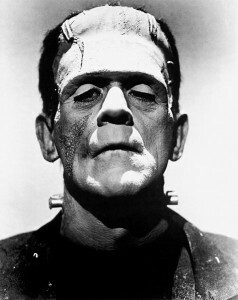

The Fear Index (for my money Harris's most enjoyable novel since Enigma) offers a thrillerish explanation for the events of that afternoon. Alexander Hoffmann (as in E.T.A., famous for writing stories about nutcrackers that come to life) is an awkward mathematical genius who used to work at CERN but is now running a hedge fund in Geneva. All the trading at Hoffmann Investment Technologies is done by computer algorithms. Nothing so unusual about that; but VIXAL-4, as the frankenfund is known, is special because it takes human emotional responses – above all, fear – into account in its calculations. And it's very, very good at making money. 'One could no more pass judgment on it than one could on a shark,' Hoffmann thinks, as he watches it grow implacably richer, oblivious to the misery it leaves in its wake. 'It was simply behaving like a hedge fund.'

The trouble is, if you feed an artificial intelligence – or, as Hoffmann prefers, 'autonomous machine learning' – system on fear, things are sooner or later bound to go horribly wrong. And on 6 May 2010, Alexander Hoffmann has a very, very bad day. It takes him a surprisingly long time to work out what's going on – for quite a while he can't decide if someone's out to get him or he's going mad – so you start to wonder how clever he can really be, but then readers have the edge on him, since the epigraph to the first chapter comes from Frankenstein.

It's all fairly silly, and fairly enjoyable: what better way to pass a few idle hours as the global economy goes down the pan than by reading about a bunch of really rich and really unpleasant people having a really terrible time? But if you want to know what actually happened on 6 May 2010, read MacKenzie. And if you want to read about a giant autonomous learning system that may or may not actually be taking over the world, try this.

Comments

I love Thomas Harris, and really look forward to reading the book.

My favorite movie were AI gets ot of hand is the Matrix. Computers and AI literally destroy the earth!

Regards

Chris